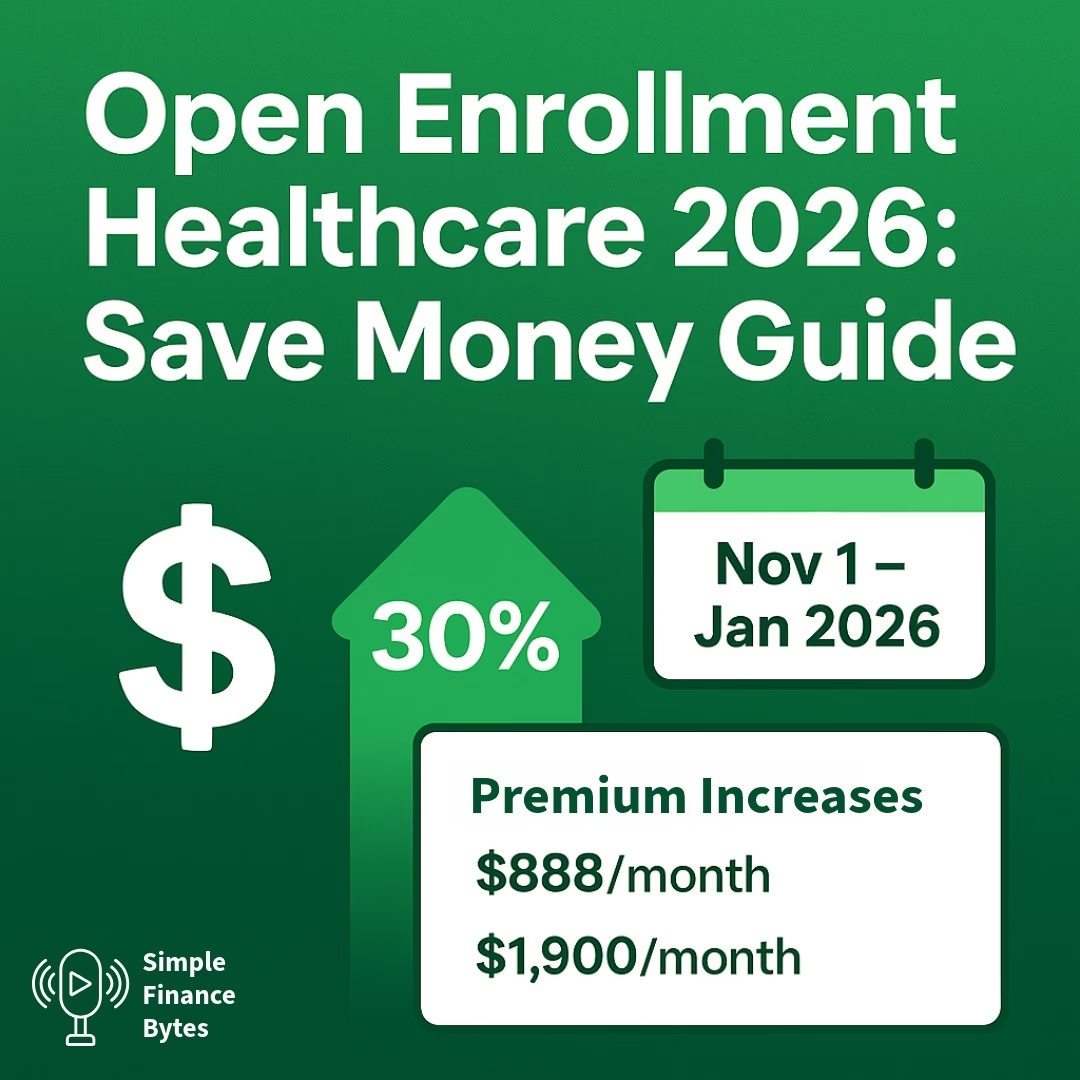

Open Enrollment Healthcare 2026: Save Money Guide

Open enrollment for 2026 healthcare plans starts November 1, 2025 and runs through mid-January 2026 in most states. If you miss this window, you’re stuck with whatever coverage you have for another year unless you experience a major life event like getting married or having a baby. Here’s the problem: premiums are jumping by record … Read more