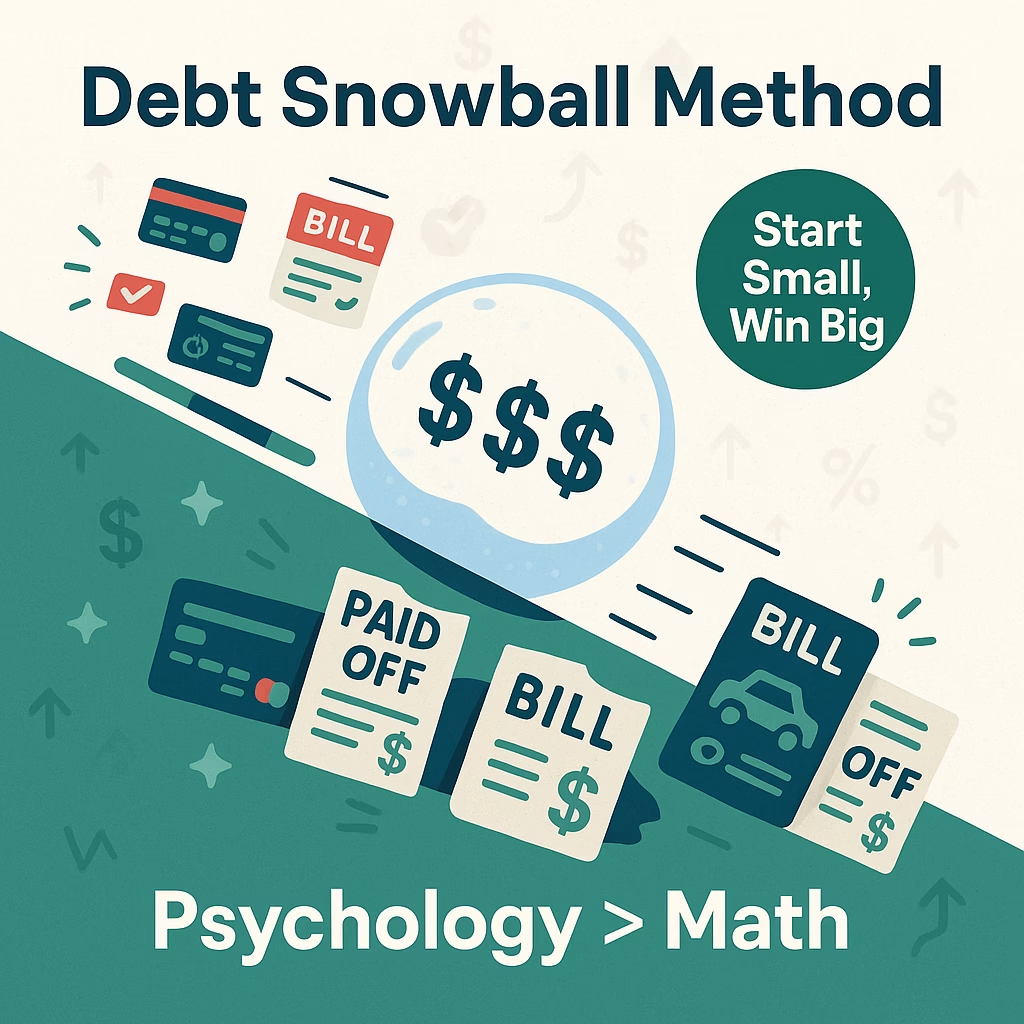

Debt Snowball Method: Why Psychology Beats Math in Debt Elimination

The debt snowball method might be the most misunderstood strategy in personal finance. Financial experts constantly criticize it because it’s not mathematically optimal, but they’re missing the point entirely. The debt snowball method works precisely because it ignores perfect math and focuses on human psychology instead. If you’re struggling with multiple debts and feeling overwhelmed … Read more