The credit union vs bank decision might be the most important financial choice you make this year. Most people stick with traditional banks out of habit, but they’re quietly losing hundreds of dollars annually in unnecessary fees. The truth is, traditional banks are designed to profit from your confusion, while credit unions exist to serve their members.

If you’re serious about personal finance and building wealth through simple finance principles, understanding where to bank is fundamental. This isn’t about minor differences in interest rates. This is about choosing between institutions that see you as a profit center versus ones that actually work for you.

The Hidden Truth About Traditional Banks

Traditional banks like Chase, Bank of America, and Wells Fargo operate as publicly traded companies. Their primary obligation isn’t to you as a customer but to their shareholders who demand quarterly profit growth. Every fee they charge you directly contributes to those profits.

Here’s exactly how traditional banks extract money from regular people:

Monthly maintenance fees ranging from $12 to $25 per month add up to $144 to $300 per year just for having a checking account. Overdraft fees are deliberately designed to maximize charges by processing your largest transactions first, creating multiple overdraft situations in a single day. Each overdraft can cost $35, and many banks allow multiple charges per day.

Minimum balance requirements punish you for not having enough money, which is backwards logic. ATM fees hit you twice when using out-of-network ATMs, with both your bank and the ATM owner charging fees. Low interest rates on savings accounts, often 0.01% to 0.05% annually, mean your money loses value to inflation while the bank profits from lending it at much higher rates.

The complexity is intentional. The more confusing their fee structures are, the more likely you are to accidentally trigger charges. Banks spend billions on lobbying to maintain this system because it’s incredibly profitable for them.

Why the Credit Union vs Bank Comparison Favors Credit Unions

Credit unions operate under a completely different model that benefits their members instead of outside shareholders. Here’s what makes the credit union vs bank comparison so clear cut:

Member Ownership Structure

Credit unions are not-for-profit organizations owned by their members. When a credit union makes money, it gets reinvested back into better services, higher interest rates on savings, or lower fees. There are no shareholders demanding ever-increasing profits at your expense.

Superior Fee Structures

Most credit unions offer free checking and savings accounts with no monthly maintenance fees and no minimum balance requirements. Overdraft fees, when they exist at all, are typically much lower than traditional banks. Many credit unions have eliminated overdraft fees entirely or offer overdraft protection services.

Better Interest Rates

Credit unions consistently offer higher interest rates on savings accounts and certificates of deposit. They also provide lower interest rates on loans including auto loans, mortgages, and personal loans. This happens because they’re not trying to maximize profits for external shareholders.

Personal Service That Actually Helps

Credit unions are typically smaller and more community-focused. When you call, you’re more likely to speak with a human being who has the authority and desire to solve your problem. Many credit union employees are genuinely invested in helping members succeed financially.

Extensive ATM and Branch Networks

Modern credit unions participate in shared branching networks and ATM cooperatives. This means you can bank at thousands of other credit unions nationwide and use tens of thousands of fee-free ATMs. The old argument about limited access no longer holds true.

Addressing Common Credit Union Concerns

When people consider the credit union vs bank decision, they often raise these concerns:

Technology and convenience: Most credit unions now offer mobile apps and online banking that rival or exceed what traditional banks provide. Many have embraced modern financial technology faster than big banks because they’re not weighed down by legacy systems.

Membership requirements: While some credit unions have membership requirements, they’re usually easy to meet. You might need to live in a certain area, work for a particular employer, or make a small donation to a partner nonprofit. These requirements are rarely actual barriers.

Safety and insurance: Credit unions are insured by the NCUA (National Credit Union Administration) just like banks are insured by the FDIC. Your deposits are equally safe up to $250,000 per account.

The Simple Finance Banking Strategy

The smartest personal finance approach uses both a credit union and an online bank in a two-account strategy that maximizes benefits while protecting your money.

Your Credit Union Account

Choose a local credit union that offers zero-fee checking and savings accounts. This becomes your financial “bunker” where you keep your emergency fund and handle basic banking needs. Keep this account offline as much as possible. Don’t link it to numerous apps or use it for online purchases. This protects your primary savings from fraud and data breaches.

Your Online Banking Partner

Pair your credit union with an online bank or fintech service like Discover Bank or a similar institution. These platforms offer excellent online banking with competitive interest rates and robust mobile apps. Use this account for online bill pay, subscription management, and any online transactions.

This two-account firewall strategy means that if your online account gets compromised, your credit union and emergency savings remain completely protected. You get the best of both worlds: local, personal service from your credit union and cutting-edge technology from your online bank.

How to Choose the Right Credit Union

Not all credit unions are equal in the credit union vs bank comparison. Here’s what to look for:

Zero fees are non-negotiable. Your credit union should offer free checking and savings with no monthly maintenance fees and no minimum balance requirements. If they charge monthly fees, keep looking.

Verify NCUA insurance. This should be prominently displayed on their website. No NCUA insurance means your money isn’t protected.

Check their ATM network. Ensure they participate in a large shared ATM network like CO-OP or Allpoint for fee-free access to thousands of ATMs.

Test their technology. Download their mobile app and explore their website. You’ll be using these regularly, so they need to work well.

Review loan rates. Even if you don’t need a loan now, check their rates for auto loans, mortgages, and personal loans. When you do need to borrow, competitive rates matter.

Start your search with credit unions in your immediate area, then expand outward. Local credit unions often provide the most personal service and community connection.

The Real Cost of Banking With Traditional Banks

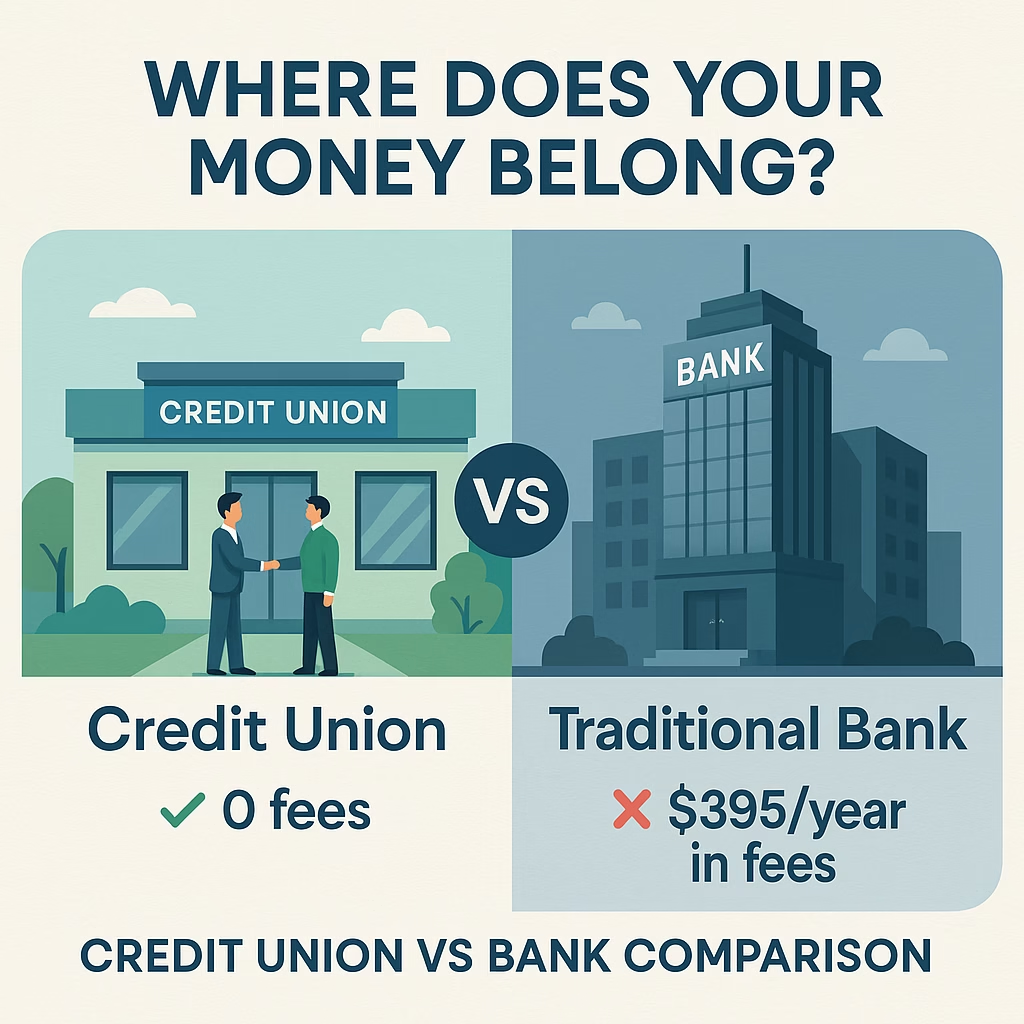

Let’s put real numbers on the credit union vs bank difference. A typical person banking with a traditional bank might pay:

- $180 annually in monthly maintenance fees

- $105 in overdraft fees (three incidents per year)

- $60 in ATM fees (five out-of-network uses per month)

- $50 in miscellaneous fees (account minimums, statement fees, etc.)

That’s $395 per year just to access your own money. Over 10 years, that’s $3,950 that could have gone into investments or savings instead.

The same person at a well-chosen credit union would pay close to zero in fees while earning higher interest on their savings. The financial impact compounds over time, making the credit union vs bank decision even more important for long-term wealth building.

Making the Switch: Your Action Plan

If the credit union vs bank comparison has convinced you to make a change, here’s how to do it safely:

First, audit your current banking costs. Add up every fee you paid in the past 12 months. The number will likely shock you.

Second, research credit unions in your area using the Credit Union National Association website. Look for institutions that meet the criteria outlined above.

Third, open your new credit union accounts first and test them out before moving everything over. Make sure their systems work well for your needs.

Fourth, gradually transfer your direct deposits and automatic payments. Take your time to ensure nothing gets missed during the transition.

Fifth, once comfortable with your credit union, consider adding an online bank for your day-to-day digital transactions.

Don’t rush the process. A careful transition ensures you avoid any disruptions to your financial life while positioning yourself for significant long-term savings.

Beyond Banking: Building Financial Freedom

The credit union vs bank decision is just one part of mastering personal finance through simple finance principles. Once you eliminate banking fees, you free up money for more important financial goals like building an emergency fund, paying off debt, or investing for the future.

Every dollar you save on banking fees can go into a high-yield savings account, Roth IRA, or low-cost index fund. Small changes in how you bank lead to significant improvements in your overall financial picture.

The goal isn’t perfection. The goal is progress toward financial independence using straightforward strategies that actually work for regular people.

Final Thoughts

The credit union vs bank comparison isn’t even close when you look at the facts. Credit unions consistently offer better rates, lower fees, and superior customer service because they’re designed to serve members rather than extract profits.

Most people stay with traditional banks out of habit or misconceptions about credit union limitations that no longer apply. Modern credit unions offer all the convenience of big banks with the member-focused service that makes them fundamentally different.

Your banking choice affects every aspect of your financial life. Choose institutions that work for you rather than against you. The money you save on fees can be invested in building the financially independent future you want.

Making the switch from a traditional bank to a credit union is one of the simplest ways to immediately improve your personal finance situation. The time you spend researching and switching will pay dividends for years to come. Be sure to sign up for our FREE Newsletter where we share all of our best financial freedom and independence content!